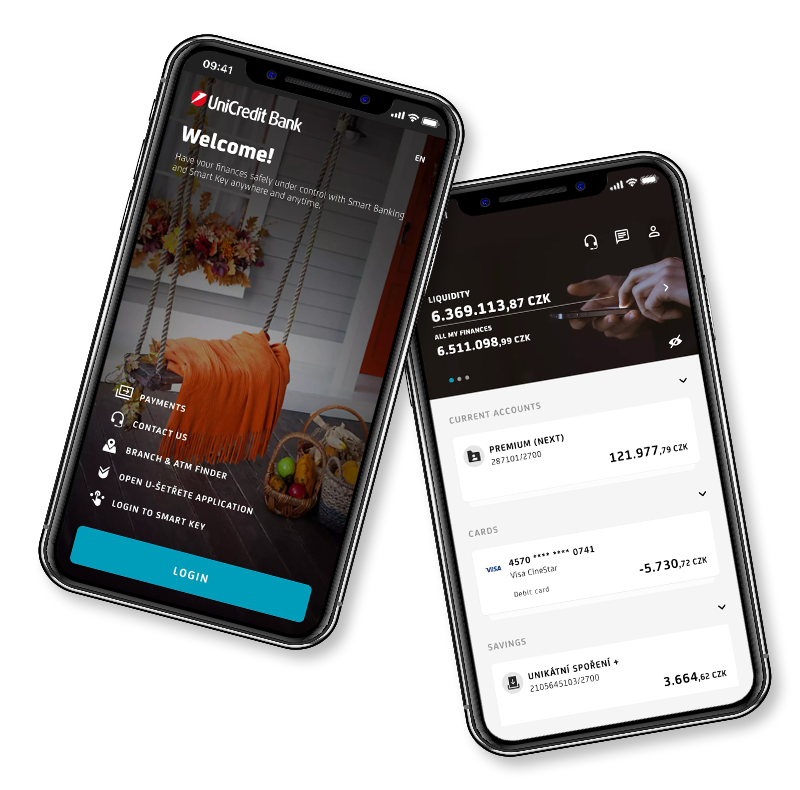

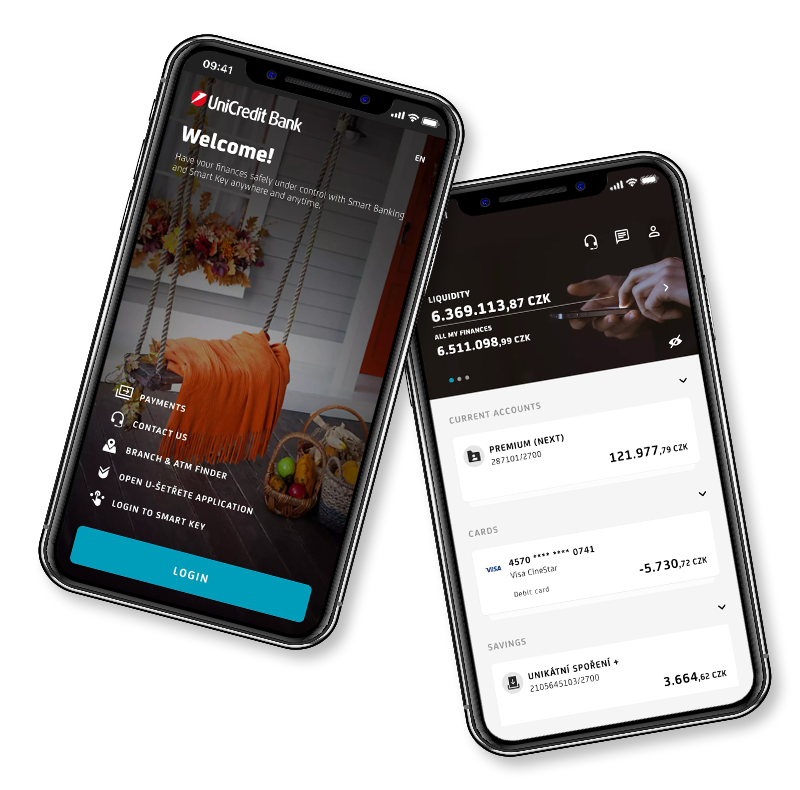

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

You are using an old web browser. We recommend updating to the latest version for correct and flawless functionality.

Manage your finances from anywhere and at any time. All you need is an Internet connection. BusinessNet Professional is a secure and user-friendly Internet banking tailored precisely to the demanding needs of corporate clients.

| Current accounts | FROM | TO | RATE |

|---|---|---|---|

| START | 0 | -- | 0,00 % |

| OPEN | 0 | -- | 0,00 % |

| TOP |

0 | -- | 0,00 % |

| CHILDREN account | 0 30 000 |

29 999 -- |

0,25 % 0,01 % |

| CURRENT ACCOUNTS | FROM |

TO | RATE |

| Base Deposit Rate (BDR) – for accounts in CZK |

0 | -- | 0,00 % |

| Base Deposit Rate (EUR BDR) – for accounts in EUR | 0 | -- | 0,00 % |

| Special Deposit Rate (SDR) – for accounts in CZK | 0 | -- | 0,00 % |

| Special Deposit Rate (EUR SDR) – for accounts in EUR | 0 | -- | 0,00 % |

| Reference Deposit Rate (RDR) – for accounts in CZK | 0 | -- | 0,00 % |

| Reference Deposit Rate (EUR RDR) – for accounts in EUR | 0 | -- | 0,00 % |

| Custody Account Deposit Rate (CADR) – for accounts in CZK | 0 |

-- |

0,80 % |

| Corporate Deposit Rate (CDR) – for accounts in CZK | 0 | -- | 0,65 % |

| Corporate Deposit Rate (CDR) – for accounts in EUR | 0 | -- | 0,40 % |

| PERSONAL ACCOUNTS NO LONGER ON OFFER | FROM | TO | RATE |

|---|---|---|---|

| U konto | 0 | -- | 0,01 % |

| U konto PREMIUM |

0 | -- | 0,01 % |

| Cool account PRO MLADÉ, EXPRESNÍ account, AKTIVNÍ account, PERFEKTNÍ account, SENIOR account |

0 | -- | 0,01 % |

| POHODA account, Partners account, MOZAIKA account, KOMPLET account, Personal Menu Forte, Personal menu Grand |

0 | -- | 0,01 % |

| EXKLUSIVE account | 0 | -- | 0,1 % |

| Account Partners Plus |

0 150 000 |

149 999 -- |

0,00 % 0,00 % |

| Student account | 0 | -- | 0,01 % |

| KOMFORT account, KOMFORT GLOBAL account | 0 50 000 500 000 |

49 999 499 999 -- |

0,01 % 0,01 % 0,01 % |

| KOMPLET account for notaries, PERFEKTNÍ account for notaries | 0 | -- | 0,01 % |

| BUSINESS ACCOUNTS AND BUSINESS CURRENT ACCOUNTS |

FROM | TO | RATE |

|---|---|---|---|

| BUSINESS START | 0 | -- | 0,01 % |

| BUSINESS OPEN | 0 | -- | 0,01 % |

| BUSINESS TOP | 0 | -- | 0,01 % |

| PROFESE Plus account | 0 | -- | 0,05 % |

| DOMOV account | 0 500 000 |

499 999 -- |

0,01 % 0,01 % |

| SPECIAL-PURPOSE ACCOUNTS |

FROM | TO | RATE |

| Custody account for notaries CZK | 0 | -- | CADR + 0,2 % |

| Custody account for notaries EUR | 0 | -- | 0,00 % |

| Custody account for notaries USD | 0 | -- | 0,10 % |

| Custody account for lawyers CZK | 0 | -- | CADR + 0,2 % |

| Custody account for lawyers EUR | 0 | -- | 0,00 % |

| Custody account for lawyers USD | 0 | -- | 0,10 % |

| Accounts for bankruptcy trustees CZK | 0 | -- | CADR + 0,2 % |

| Accounts for bankruptcy trustees EUR | 0 | -- | 0,00 % |

| Accounts for bankruptcy trustees USD | 0 | -- | 0,00 % |

| Auctioneer's accounts CZK | 0 | -- | CADR + 0,2 % |

| Auctioneer's accounts EUR | 0 | -- | 0,00 % |

| Auctioneer's accounts USD | 0 | -- | 0,00 % |

| EXEKUTOR account - enforcement CZK | 0 | -- | CADR + 0,2 % |

| BUSINESS ACCOUNTS NO LONGER ON OFFER | FROM | TO | RATE |

|---|---|---|---|

| U konto BUSINESS | 0 | -- | 0,01 % |

| Current account for freelancers | 0 | -- | 0,00 % |

| Business account START, Business account ACTIVE, Business account MASTER, Business account GOLD |

0 | -- | 0,01 % |

| PRO PODNIKATELE account, BUSINESS Konto 5, BUSINESS Konto 20, BUSINESS Konto 70, BUSINESS Konto Exklusive |

0 | -- | 0,01 % |

| BUSINESS Konto 70 Plus, BUSINESS Konto Exklusive Plus | 0 500 000 |

499 999 -- |

0,01 % 0,01 % |

| Kondominium account | 0 500 000 |

499 999 -- |

0,01 % 0,01 % |

| Professional Menu, Top Professional Menu | 0 500 000 |

499 999 -- |

0,01 % 0,01 % |

| PROFESE account | 0 | -- | 0,05 % |

The credit balance of individually maintained current and technical accounts in CZK and in foreign currencies is not interest bearing by default.

The credit balance of current accounts in CZK for currencies involved in any accounts/packages other than the above stated and current accounts in foreign currencies involved in the accounts/packages is not interest bearing by default.

With effect from 1 January 2022, Interbanking rates EONIA *, USD LIBOR 1week, USD LIBOR 2months, GBP LIBOR (all tenors), CHF LIBOR (all tenors) and JPY LIBOR (all tenors) are being phased out and will no longer be published. After this date, credit interest on the accounts where these interest rates have been agreed will follow the Product Terms and Conditions for Accounts and Payments (unless otherwise agreed in a specific case).

* with effect from 3 January 2022

The late payment interest rate for receivables of the Bank in CZK is set as five times the rate announced by the CNB as the Lombard rate for the Czech currency during the period of delay.

The late payment interest rate for receivables of the Bank in foreign currencies is set as five times the rate announced by the Central Bank of the country of the relevant currency as the Lombard or its corresponding rate for the relevant currency during the period of delay.

If, however, the five times such stated (Lombard or similar) rate is lower than 20% p.a., then the Bank is entitled to apply a fixed late payment interest of 20% p.a. to the outstanding amounts.

Overdue Bank’s receivables from individuals – non-entrepreneurs bear default interest rates as per the Government Regulation No. 351/2013 as amended, currently at 12% p.a.

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 499 999 | 2,5 | 01.04.2022 |

| 500 000 | --- | 0 | 07.02.2022 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 499 999 | 0,05 | 01.02.2017 |

| 500 000 | --- | 0,01 | 01.03.2016 |

Interest rates are given in % p.a. For remuneration purposes, the credit balance of PRIMA savings account is divided into deposit and corresponding interest rate zones, and each portion of the credit balance of PRIMA savings account bears interest at a rate corresponding to the relevant interest rate zone.

| Currency | From | To | Rate |

|---|---|---|---|

| Corporate Deposit Rate (CDR) – for accounts in CZK | 0 | --- | 0,65 % |

| Corporate Deposit Rate (CDR) – for accounts in EUR | 0 | --- | 0,40 % |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic |

0 | 999 999 | 0,1 | 01.02.2017 |

| 1 000 000 | --- | 0,01 | 01.03.2016 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 199 999 | 0,01 | 01.01.2017 |

| 200 000 | 19 999 999 | 0,05 | 01.01.2017 | ||

| 20 000 000 | --- | 0,01 | 01.01.2017 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | Do | Rate | Valid from |

| CZK | Czech Republic |

0 | 74 999 | 0,01 | 01.01.2017 |

| 75 000 | 149 999 | 0,05 | 01.01.2017 | ||

| 150 000 | --- | 0,01 | 01.01.2017 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic |

0 | 149 999 | 0,01 | 01.01.2017 |

| 150 000 | 299 999 | 0,05 | 01.01.2017 | ||

| 300 000 | --- | 0,01 | 01.01.2017 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 299 999 | 0,01 | 01.01.2017 |

| 300 000 | 599 999 | 0,05 | 01.01.2017 | ||

| 600 000 | --- | 0,01 | 01.01.2017 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 599 999 | 0,01 | 01.01.2017 |

| 600 000 | 1 199 999 | 0,05 | 01.01.2017 | ||

| 1 200 000 | --- | 0,01 | 01.01.2017 |

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 199 999 | 0,01 | 01.01.2017 |

| 200 000 | 19 999 999 | 0,10 | 01.01.2017 | ||

| 20 000 000 | --- | 0,01 | 01.01.2017 |

Note

Interest rates are given in % p.a. For remuneration purposes, the credit balance of Unique savings is divided into deposit and corresponding interest rate zones, and each portion of the credit balance of Unique savings account bears interest at a rate corresponding to the relevant interest rate zone.

| Amount | ||||||

|---|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from | Valid till |

| CZK | Czech Republic | 0 | unlimited | 5,50 | 01.07.2022 | 31.03.2024 |

| CZK | Czech Republic | 0 | unlimited | 4,75 | 01.04.2024 | 01.05.2024 |

| CZK | Czech Republic | 0 | unlimited | 4,25 | 02.05.2024 | 31.05.2024 |

| CZK | Czech Republic | 0 | unlimited | 4,25 | 01.06.2024 | 30.06.2024 |

| CZK | Czech Republic | 0 | unlimited | 4,00 | 01.07.2024 | 31.07.2024 |

| CZK | Czech Republic | 0 | unlimited | 3,50 | 01.08.2024 | 30.09.2024 |

| CZK | Czech Republic | 0 | unlimited | 3,25 | 01.10.2024 | 31.10.2024 |

| CZK | Czech Republic | 0 | unlimited | 3,00 | 01.11.2024 | 30.11.2024 |

| CZK | Czech Republic | 0 | 1 000 000,00 | 3,75 | 20.11.2024 | 31.12.2024 |

| CZK | Czech Republic | 1 000 000,01 | unlimited |

3,00 | 20.11.2024 | 31.12.2024 |

| CZK | Czech Republic | 0 | 1 000 000,00 | 3,75 | 1.1.2025 | 2.3.2025 |

| CZK | Czech Republic | 1 000 000,01 | unlimited | 3,00 | 1.1.2025 | 2.3.2025 |

| CZK | Czech Republic | 0 | 1 000 000,00 |

3,75 | 3.3.2025 | 31.3.2025 |

| CZK | Czech Republic | 1 000 000,01 | unlimited | 2,75 | 3.3.2025 | 31.3.2025 |

| CZK | Czech Republic | 0 | 1 000 000,00 | 3,50 | 1.4.2025 | 1.5.2025 |

| CZK | Czech Republic | 1 000 000,01 |

unlimited | 2,75 | 1.4.2025 | 1.5.2025 |

| CZK | Czech Republic | 0 | 1 000 000,00 | 3,50* | 2.5.2025 | 1.6.2025 |

| CZK | Czech Republic | 1 000 000,01 | unlimited | 2,75** | 2.5.2025 | 1.6.2025 |

*The interest rate of 3.50% p. a. consists of a Basic Interest Rate of 1% p. a., a Bonus Rate of 2.25% p. a. and an Extra Bonus Rate of 0.25% p. a. **The interest rate of 2.75% p. a. consists of a Basic Interest Rate of 1% p. a. and a Bonus Rate of 1.75% p. a.

Definitions of the terms used and detailed conditions for obtaining the rate can be found HERE.

| Amount | Period for release of financial resources | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Code | Currency name | From | To | 1 week |

2 weeks |

1 month |

2 months |

3 months |

6 months |

Valid from |

| CZK | KORUNA | 0 | 29 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 |

| 30 000 | --- | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| CHF | SWISS FRANC | 0 | 1 499 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 01.01.2016 |

| 1 500 | 9 999 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 01.01.2016 | ||

| 10 000 | 49 999 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 01.01.2016 | ||

| 50 000 | 149 999 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 01.01.2016 | ||

| 150 000 | --- | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 01.01.2016 | ||

| EUR | EURO | 0 | 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 |

| 1 000 | 9 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 10 000 | 49 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 50 000 | 149 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 150 000 | --- | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| USD | AMERICAN DOLLAR | 0 | 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 |

| 1 000 | 9 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 10 000 | 49 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 50 000 | 149 999 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 | ||

| 150 000 | --- | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 01.10.2015 |

For remuneration purposes, the credit balance of Savings accounts is divided into deposit and corresponding interest rate zones, and each portion of the credit balance of Savings accounts bears interest at a rate corresponding to the relevant interest rate zone.

Savings accounts in CZK with 2 months’ notice period have not been offered by the Bank since 1. 3. 2010.

| Amount | Period for release of financial resources 1 DAY | ||||

|---|---|---|---|---|---|

| Code | Currency name | From | To | Rate | Valid from |

| CZK | KORUNA | 0 | 74 999 | 0,01 | 01.10.2015 |

| 75 000 | 149 999 | 0,01 | 01.10.2015 | ||

| 150 000 | --- | 0,01 | 01.10.2015 |

The savings account with one day’s period for release of financial resources within PRAKTIK account or Partners account is no longer offered by the Bank.

Note: Interest rates are given in % p.a.

| Amount | |||||

|---|---|---|---|---|---|

| Code | Country | From | To | Rate | Valid from |

| CZK | Czech Republic | 0 | 999 999 | 0,1 | 01.02.2017 |

| 1 000 000 | --- | 0,01 | 01.03.2016 |

Interest rates are given in % p.a. For remuneration purposes, the credit balance of MULTI savings account is divided into deposit and corresponding interest rate zones, and each portion of the credit balance of MULTI savings account bears interest at a rate corresponding to the relevant interest rate zone.

| Amount | ||||

|---|---|---|---|---|

| Currency | Country | From | To | Rate |

| CZK | Czech Republic | 0 | 199 999 | 0,00 % |

| 200 000 | 499 999 | 0,00 % | ||

| 500 000 | 999 999 | 0,00 % | ||

| 1 000 000 | 4 999 999 | 0,00 % | ||

| 5 000 000 | 9 999 999 | 0,00 % | ||

| EUR | EMU | 0 | 9 999 | 0,00 % |

| 10 000 | 49 999 | 0,00 % | ||

| 50 000 | 249 999 | 0,00 % | ||

| 250 000 | 499 999 | 0,00 % | ||

| USD | USA | 0 | 9 999 | 0,00 % |

| 10 000 | 49 999 | 0,00 % | ||

| 50 000 | 249 999 | 0,00 % | ||

| 250 000 | 499 999 | 0,00 % |

Without notice period

| Amount | |||

|---|---|---|---|

| Currency | From | To | Rate |

| CZK | 0 | --- | 0,01 % |

| USD | 0 | --- | 0,01 % |

| EUR | 0 | --- | 0,01 % |

With notice period

| Amount | Period | |||

|---|---|---|---|---|

| Currency | From | To | 3 months | 6 months |

| CZK | 0 | --- | 0,01 % | 0,02 % |

Note:

Interest rates are given in % p.a. For remuneration purposes, the credit balance of Plus savings account and Deposit books is divided into deposit and corresponding interest rate zones, and each portion of the credit balance of Plus savings account and Deposit books bears interest at a rate corresponding to the relevant interest rate zone.

Valid from: 14.5.2025 The rates are given in % p. a.

| CZK: |

1 MON. | 3 MON. | 6 MON. | 12 MON. |

|---|---|---|---|---|

| 30,000 - 999,999 CZK | 2.75 | 3.00 | 2.60 | 2.70 |

| 1,000,000 - 10,000,000 CZK | 2.85* | 3.00 |

2.70* | 2.80* |

* Interest discount for deposits over CZK 1,000,000 applies only to natural persons who are not entrepreneurs

Valid from: 5.5.2025 The rates are given in % p. a.

| EUR: |

1 MON. |

3 MON. | 6 MON. |

12 MON. |

|---|---|---|---|---|

1 000 – 100 000 EUR |

1.30 | 1.70 | 1.65 | 1.45 |

Valid from: 04.04.2016

| CZK: THS |

1 WEEK |

2 WEEKS |

1 MON. | 2 MON. | 3 MON. | 6 MON |

9 MON. | 12 MON. |

|---|---|---|---|---|---|---|---|---|

| <0 - 50)* | 0,06 | 0,06 | 0,06 | 0,07 | 0,12 | 0,12 | 0,16 | 0,16 |

| <50 - 200) | 0,06 | 0,06 | 0,06 | 0,07 | 0,12 | 0,12 | 0,16 | 0,16 |

| <200 - 500) | 0,06 | 0,06 | 0,06 | 0,07 | 0,12 | 0,12 | 0,16 | 0,16 |

| <500 - 1000) | 0,06 | 0,06 | 0,06 | 0,07 | 0,12 | 0,12 | 0,16 | 0,16 |

| <1000 - 5000) | 0,06 | 0,06 | 0,06 | 0,07 | 0,12 | 0,12 | 0,16 | 0,16 |

* Minimum deposit CZK 20 000,-

| EUR: THS |

1 WEEK | 2 WEEKS |

1 MON. | 2 MON. | 3 MON. | 6 MON |

9 MON. | 12 MON. |

|---|---|---|---|---|---|---|---|---|

| <1 - 10) | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 |

| <10 - 50) | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 |

| <50 - 250) | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 |

| <250 - 500) | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 |

| USD: THS |

1 WEEK |

2 WEEKS |

1 MON. | 2 MON. | 3 MON. | 6 MON. | 9 MON. | 12 MON. |

|---|---|---|---|---|---|---|---|---|

| <1 - 10) | 0,17 | 0,17 | 0,17 | 0,17 | 0,17 | 0,21 | 0,26 | 0,46 |

| <10 - 50) | 0,17 | 0,17 | 0,17 | 0,17 | 0,17 | 0,21 | 0,26 | 0,46 |

| <50 - 250) | 0,17 | 0,17 | 0,17 | 0,17 | 0,17 | 0,21 | 0,26 | 0,46 |

| <250 - 500) | 0,17 | 0,17 | 0,17 | 0,17 | 0,17 | 0,21 | 0,26 | 0,46 |

| Active offer | ||

|---|---|---|

| Product name | Monthly interest rate | Annual interest rate |

| Credit Standard | 1,58 % p.m. | 18,96 % p.a. |

| Credit Premium | 1,33 % p.m. | 15,96 % p.a. |

| Products not actively offered | ||

|---|---|---|

| Product name | Monthly interest rate | Annual interest rate |

| MasterCard Miles and More Gold | 1,58 % p.m. | 18,96 % p.a. |

| Visa AXA | 1,95 % p.m. | 23,40 % p.a. |

| Visa Electron AXA | 1,95 % p.m. | 23,40 % p.a. |

| Visa Generali | 1,95 % p.m. | 23,40 % p.a. |

| MasterCard Agip | 1,95 % p.m. | 23,40 % p.a. |

| MasterCard Miles and More Standard | 1,95 % p.m. | 23,40 % p.a. |

In the case of individually agreed terms, the monthly and annual interest rates may differ from the above interest rates.

Overdue Bank’s receivables from individuals – non-entrepreneurs bear default interest rates as per the Government Regulation No. 351/2013 as amended, currently at 12% p.a.

| Product name | Interest rate |

|---|---|

| PRESTO Loan for everything | from 4.49 % p.a. |

| PRESTO Loan refinancing | from 4.99 % p.a. |

| PRESTO Living loan | from 6.29 % p.a. |

The interest rate from 4.49% p.a. applies to PRESTO Loan - depending on the specific assessment of the client's creditworthiness, for loans up to CZK 100,000, inclusive with a maturity of at least 48 months and sending salary to the UniCredit Bank account. Interest rate from 4.99% p.a. applies to PRESTO Loan, depends on the specific assessment of the client's creditworthiness, for loans over CZK 800,000, and sending salary to UniCredit Bank account. Loans outside these parameters bear interest at a rate of up to 13.99% p.a. For PRESTO Living Loans, the interest rate also depends on the specific creditworthiness assessment and repayment period and is from 6.29% p.a. (max. 9.99% p.a.).

Overdue Bank’s receivables from individuals – non-entrepreneurs bear default interest rates as per the Government Regulation No. 351/2013 as amended, currently at 12 % p.a.

| Product name | Interest rate |

|---|---|

| Bank overdraft | 18,00 % p.a. |

Overdue Bank’s receivables from individuals – non-entrepreneurs bear default interest rates as per the Government Regulation No. 351/2013 as amended, currently at 12 % p.a.

| Fixed period | Mortgage purpose to 80% |

Mortgage purpose from 81% to 95% |

Mortgage combined | Mortgage without purpose | ||

|---|---|---|---|---|---|---|

| 2 | from 4,49 % | from 4,99 % | from 4,49 % | from 4,49 % | ||

| 3 | from 4,49 % | from 4,99 % | from 4,49 % | from 4,49 % | ||

| 5 | from 5,19 % | from 5,69 % | from 5,19 % | from 5,19 % | ||

| Basic rate for mortgage loans – BMR | 3,54 % | |||||

Overdue Bank’s receivables from individuals – non-entrepreneurs bear default interest rates as per the Government Regulation No. 351/2013 as amended, currently at 12 % p.a.

The interest rates apply subject to taking out insurance of the ability to repay the loan.

Interest rates are established individually and are derived from the “Base Lending Rate Small Business Overdraft” (BLR SB OVERDRAFT), which is the bank’s basic interest rate for Small Business operating capital loans and is updated and announced on a daily basis.

Value of BLR SB OVERDRAFT 7.6% p.a. CZK

Value of BLR SB OVERDRAFT 3.0% p.a. EUR

Value of BLR SB OVERDRAFT 1.14% p.a. USD

The “Base Lending Rate Overdraft” and “Base Lending Rate Notice” are the bank’s basic interest rates for overdraft loans of corporate clients and the public sector and are updated on a daily basis.

| 1.5.2025 | CZK | EUR |

| Value of BLR NOTICE: | 4.08% | 2.71% |

| Value of BLR OVERDRAFT: | 4.18% | 2.81% |

| 1.4.2025 | CZK | EUR |

| Value of BLR NOTICE: | 4.12% | 2.91% |

| Value of BLR OVERDRAFT: | 4.22% | 3.01% |

| 1.2.2025 | CZK | EUR |

| Value of BLR NOTICE: | 4.31% | 3.28% |

| Value of BLR OVERDRAFT: | 4.41% | 3.38% |

| 2.1.2025 | CZK | EUR |

| Value of BLR NOTICE: | 4.36% | 3.34% |

| Value of BLR OVERDRAFT: | 4.46% | 3.44% |

| 1.12.2024 | CZK | EUR |

| Value of BLR NOTICE: | 4.37 % p.a. |

3.57 % p.a. |

|

|

|

| Value of BLR OVERDRAFT: | 4.47 % p.a. | 3.67 % p.a. |

| 1.8.2024 | CZK | EUR |

| Value of BLR NOTICE: | 5.04 % p.a. | 4.16 % p.a. |

| Value of BLR OVERDRAFT: | 5.14 % p.a. | 4.26 % p.a. |

| 13.2.2024 | CZK | EUR |

| Value of BLR NOTICE: | 6.63 % p.a. | 4.40 % p.a. |

| Value of BLR OVERDRAFT: | 6.73 % p.a. | 4.50 % p.a. |

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

Loading