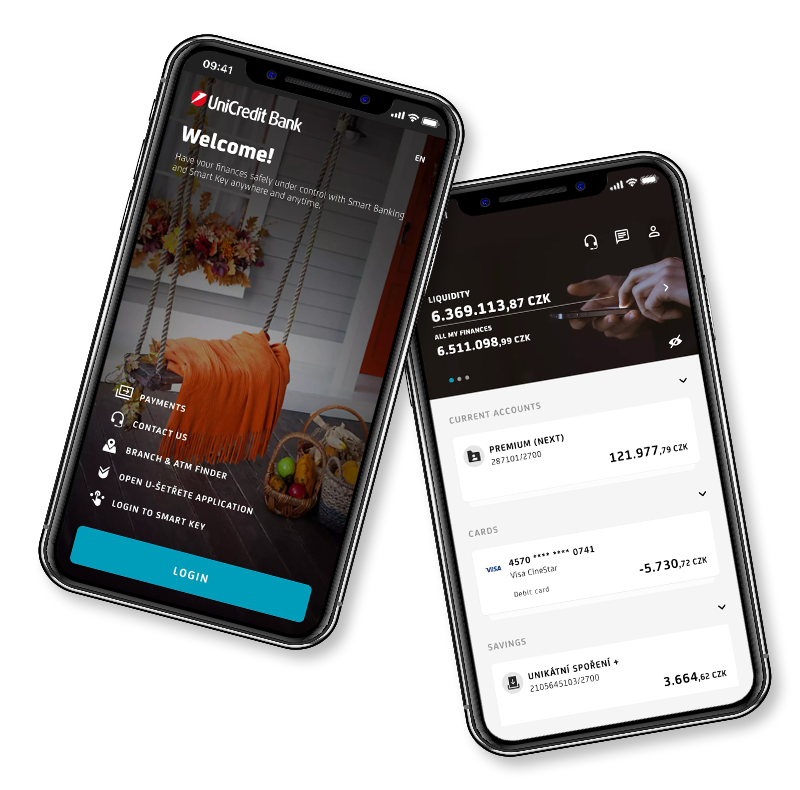

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

Enviromental Social Governance

Dear clients,

please, become familiar with the information published by UniCredit Bank pursunat to Regulation (EU) of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (hereinafter “Regulation”).

The Regulation is intended to raise awareness among end clients and is aimed at sustainable, socially responsible investment and investment promoting good governance.

Transparency towards investors is a key element of the Regulation. It is about unifying the conditions for informing final investors in individual Member States. In particular, the European Union wants to provide companies with a framework within which they will be able to offer a wide range of products while respecting sustainable financing rules.

On 25 September 2015, the UN General Assembly adopted a new global sustainable development framework: the 2030 Agenda, which has at its core the Sustainable Development Goals (SDGs).

The transition to a low‐carbon, more sustainable, resource‐efficient and circular economy in line with the SDGs is key to ensuring long‐term competitiveness of the economy of the Union.

The Paris Agreement adopted under the United Nations Framework Convention on Climate Change, which entered into force on 4 November 2016, seeks to strengthen the response to climate change by, inter alia, making finance flows consistent with a pathway towards low greenhouse gas emissions and climate‐resilient development.

The EU is committed to achieving climate neutrality by 2050. Achieving this objective will involve transforming european society and the economy, which must be cost-effective and fair, as well as socially balanced. In this context, the Commission presented an anouncement on the EU Green Deal in 2019, which is to be the EU's new growth strategy to transform the Union into a climate-neutral, fair and prosperous society with a modern, resource-efficient and competitive economy. This objective is to be achieved in particular by adopting a regulatory base in a number of closely interconnected areas of the economy. Among other things, it is necessary to redirect financial flows into sustainable investments.

In accordance with the Regulation, UniCredit Bank hereby publishes information on the incorporation of ESG procedures into its investment and insurance advice.

One of our biggest success stories in the ESG product area for individuals is Amundi's Funds with declared SFDR article 8 and 9. Detailed information on the offer can be found here One-off investments and one-off investments | UniCredit Bank Investment Funds

In the area of product offerings for entrepreneurs and small businesses, we are proud of a product categorised as Social Impact Banking, a loan called Mikro Presto Business. This loan is exceptional in its terms and conditions, particularly suitable for start-ups, early stage entrepreneurs and entrepreneurs who want to return to their business activities after a break, expand them and invest in their further development. Very simply, to qualify for this product, you just need to be a UniCredit Bank customer and have your business income sent to your business account with us.

Policy on the integration of sustainability risks – valid from 5th November 2021

Adverse sustainability impacts statement – valid from 10th March 2021

Loading