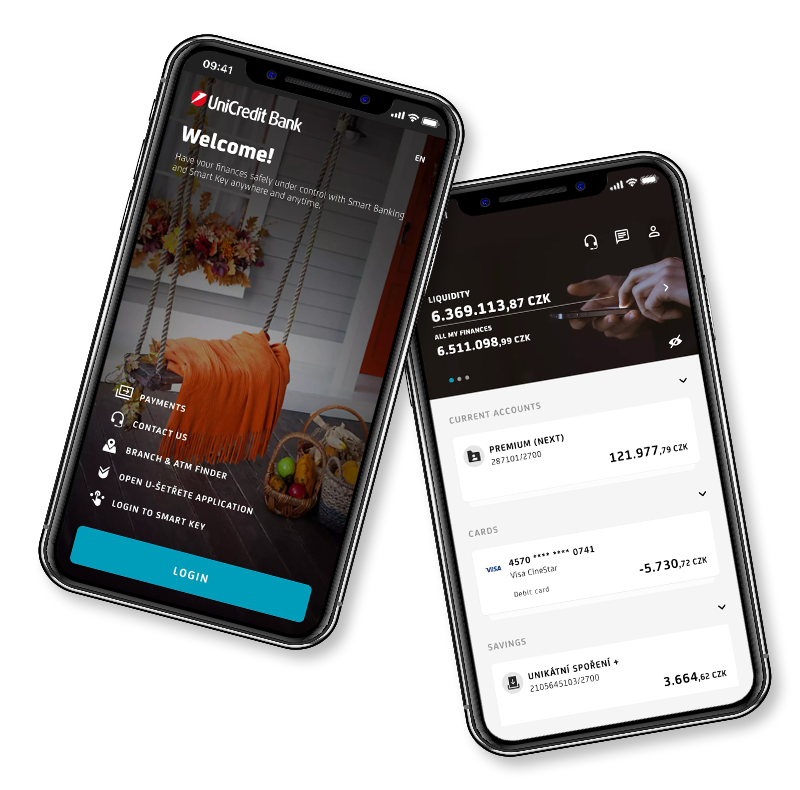

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

What is an interest rate benchmark, and why is important?

A “benchmark” is a pre-determined standard against which the performance of financial investments and lending costs are measured.

A benchmark can be used to measure the performance of an index, a security or even an investment manager. For example, mutual fund performance is often compared to changes in the “benchmark” Standard & Poor's 500 Stock Index. A benchmark can also be used to define the asset allocation of a portfolio or for computing the performance fees.

A benchmark can be used as a useful basis for cash products (corporate loans, family loans, overdrafts) and non-cash products (other more complex financial transactions such as derivatives).

Banks use benchmarks for interest rates when they calculate interest on loans, notes and deposits. For example, banks might lend money at an agreed interest rate that is set at a particular benchmark rate plus a spread. If the spread is set to 1% interest paid will be 1% more than the current benchmark rate. So, the cost of the loan goes up if the benchmark rate goes up and vice versa. In this case, the benchmark can be a reliable, independent, and relatively simple reference for all the involved parties.

Interest Rate Benchmarks are crucial to financial stability and therefore play a central role in financial markets because they are widely used by individuals and organisations throughout the economic system. The most common interest rate benchmarks are the Euro Interbank Offered Rate (EURIBOR) and the London Interbank Offered Rate (LIBOR). They form a basis for lending prices for the global financial system.

Background of IBOR (Interbank Offered Rate) Reform

In 2013, the G20 asked the Financial Stability Board (FSB) to undertake a fundamental review of major interest rate benchmarks and develop plans for possible changes to ensure that these benchmarks are robust and appropriately used by market participants.

In July 2014, the FSB published its recommendations, which essentially set out two core objectives: (1) reform IBORs (Interbank Lending Rates, of which LIBOR is one of the most commonly used) to strengthen existing methodologies, and to make them more grounded on actual transactions; and (2) develop alternative reference rates meeting the requirement for robust reference rates.

In this context, the FSB calls for significant and sustained efforts by regulators and by financial and non-financial firms across many jurisdictions to transition away from all London Interbank Offered Rate (LIBOR) at latest by end-2021 in order to mitigate potential risks arising from the expected cessation of LIBOR.

EU Benchmark Regulation (BMR)

The EU Benchmark Regulation 2016/1011 (BMR) – which took effect January 1st 2018 - made the EU among the first areas to impose a comprehensive, legally binding regulatory regime governing financial benchmarks. BMR prohibits EU-supervised users from using a benchmark unless its administrator is approved by a national regulator in one of the EU Member States and appears on the benchmarks register maintained by the European Securities and Markets authority (ESMA), an EU supranational supervisory authority.

More importantly for borrowers and lenders, BMR requires that such contracts and agreements include sustainable fallback arrangements, which state what benchmark rate parties will use in the event that the initially agreed upon benchmark rate is no longer available.

Reform at a Glance

As financial markets transition away from using LIBOR to an alternative, banks and their clients will make a coordinated effort for the transition to happen smoothly. Below is a brief guide.

EURIBOR: can continue to be used as a benchmark under BMR rules

The Euro Interbank Offered Rate (EURIBOR) is an unsecured market benchmark rate calculated by a panel of selected banks, and administrated and published by the European Money Markets Institute (EMMI) for several maturities (one week, and one, three, six and twelve months).

In order to satisfy the requirements of the European Benchmark Regulation, EMMI has developed a new calculation methodology (so called “Hybrid Methodology”). Under the new Hybrid Methodology, EURIBOR is calculated using real transactions whenever such transactions are available.

From EONIA to €STR

EONIA in its previous form could become non-compliant with the EU BMR, given the scarcity of underlying transactions and high concentration of volumes among a small number of contributors.

In order to maintain EONIA for a transitional period and until its discontinuation on January 3rd 2022, its methodology has been changed and, since October 2nd 2019, EONIA has been computed as €STR plus a fixed spread of 8.5 basis points. The €STR reflects the wholesale euro unsecured overnight borrowing costs of euro area banks and is based exclusively on real transactions reported to the ECB.

EONIA will be published for the last time on January 3rd 2022 and discontinued thereafter; all contracts maturing after this date and referring to EONIA must have a written fallback clause providing for its substitution.

From London Interbank Offered Rate (LIBOR) to Alternative Reference Rate (ARR)

LIBOR, the London Interbank Offered Rate, is currently produced centrally in London by ICE Benchmark Administrator in seven tenors (or lengths), from overnight up to 12 months, for 4 currencies (see the table below) and the UK’s Prudential Regulation Authority (PRA) is responsible for its regulation.

The Financial Conduct Authority (FCA) has made it clear that the publication of LIBOR is not guaranteed beyond 2021 and thus firms must transition the existing contracts to Alternative Reference Rates before this date (ARRs).

ARRs are overnight nearly risk-free reference rates, which have been identified as alternative benchmarks for the existing key interbank offered rates (IBORs). Such rates are robust and are anchored in active, liquid underlying markets.

A selection of possible alternatives to LIBOR around the world:

LIBORs |

ARRs |

LIBOR USD |

SOFR, Secured overnight financing rate (Secured Transactions) |

LIBOR GBP |

SONIA, Sterling overnight index average (Unsecured Transactions) |

LIBOR JPY |

TONAR, Tokyo overnight average (Unsecured Transactions) |

LIBOR CHF |

SARON, Swiss average rate overnight (Secured Transactions) |

Fallback Provisions

To address the risk that one or more LIBORs or benchmarks are discontinued while market participants continue to have exposure to that rate, financial institutions and clients are encouraged to agree to contractual fallback provisions using ARRs as replacement rates.

The fallback rates are being developed to ensure contracts’ continuity once LIBOR is discontinued. Furthermore, market participants must ensure that the contracts align as closely as possible to the original agreement after the fallback kicks in, resulting in a rate that is predictable, transparent and fair.

Work is underway across numerous jurisdictions to develop contractual fallbacks in order to mitigate the risk associated with the uncertainty of LIBOR’s existence post-2021 and therefore to reduce potential uncertainties if it ceases to be used.

The impacts for our Clients

The IBOR reform impacts existing/new contracts, and particularly credit agreement and financial contracts indexed to a LIBOR. Whilst LIBOR will continue to be published until the end of 2021, the Bank of England and the Financial Conduct Authority and the Working Group on Sterling Risk-Free Reference Rates expect all UK-based financial institutions to cease issuing new LIBOR-based products maturing beyond 2021 by the end of 1Q 2021. Consequently, UniCredit will review its offer according to which benchmark rates are available on the markets and within the regulatory framework.

UniCredit at Work

UniCredit set up a dedicated working group aimed at ensuring compliance with the European Benchmark Regulation (BMR) and managing an orderly transition from LIBOR to ARRs. Moreover, UniCredit is taking part in several international working groups in order to be aligned with and contribute to the IBOR transition process.

Disclaimer

The content of this page reflects UniCredit’s current understanding of the IBOR Transition and are subject to change. Please note that the overview provided here is not meant to be complete nor exhaustive. It is not intended to substitute a thorough assessment by independent professionals how these developments may impact you or your organisation and does not constitute advice or recommendation. UniCredit will seek to update this page periodically and/or provide communication relating to market developments on the benchmark interest rate reform

Loading