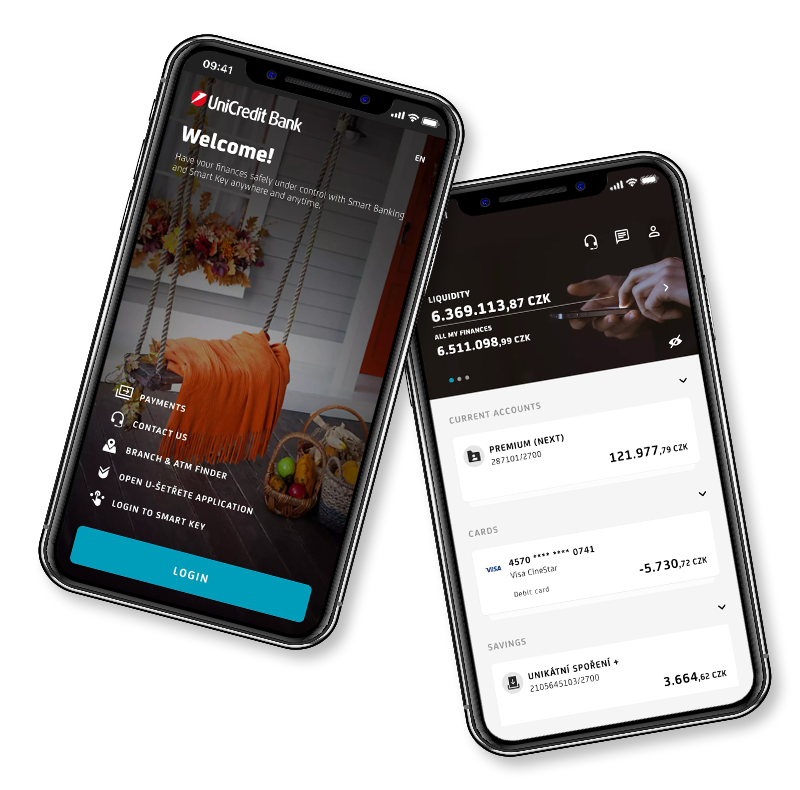

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

IT IS IMPORTANT FOR US TO BE ALWAYS THERE FOR YOU IN THIS DIFFICULT SITUATION AND TO HELP YOU MITIGATE THE UNEXPECTED IMPACTS ASSOCIATED WITH THE SPREAD OF COVID-19.

Starting from 1.10. 2020 there is no possibility to accept deferral requests.

Dear clients,

In accordance with the newly adopted Act on deferral of loan repayments below, we provide information for deferred monthly repayment of mortgage loans, PRESTO Loans and loans for small businesses and sole traders.

If you wish to postpone installments of a credit product (e.g. consumer credit, leasing) from UniCredit Leasing, please read HERE.

Our main priority is the health of you, our clients and UniCredit Bank employees, so we will manage everything remotely, without having to visit a branch.

Please pay attention to the correct entry of all data, which will significantly speed up the processing.

Starting from 1.10. 2020 there is no possibility to accept deferral requests.

Dear clients,

In accordance with the newly adopted Act on deferral of loan repayments, below we provide information for deferment of monthly installments for corporate investment loans.

If you wish to postpone loan installments from UniCredit Leasing CZ, a.s. (eg consumer credit, leasing), please read HERE.

Our main priority is the health of you, our clients and UniCredit Bank employees, so we will manage everything remotely, without having to visit a branch.

Please pay attention to the correct entry of all data, which will significantly speed up the processing.

Dear clients,

It is important for us in this difficult situation to always stand by you, our clients, and help you reduce the unexpected effects associated with the spread of COVID-19.

We would like to inform you that we are preparing the COVID III Guarantee Program for you in cooperation with the Czech-Moravian Guarantee and Development Bank.

The aim of the COVID III Guarantee Program is to facilitate access for small and medium-sized enterprises to operational financing whose economic activities have been, and may still be, limited due to the occurrence of coronavirus infection and related preventive measures.

If you are interested in any of these programs, please contact your banker.

Our main priority is the health of you, our clients, but also the employees of UniCredit Bank, so we will take care of everything as far as possible, without the need to visit a branch.

Loading