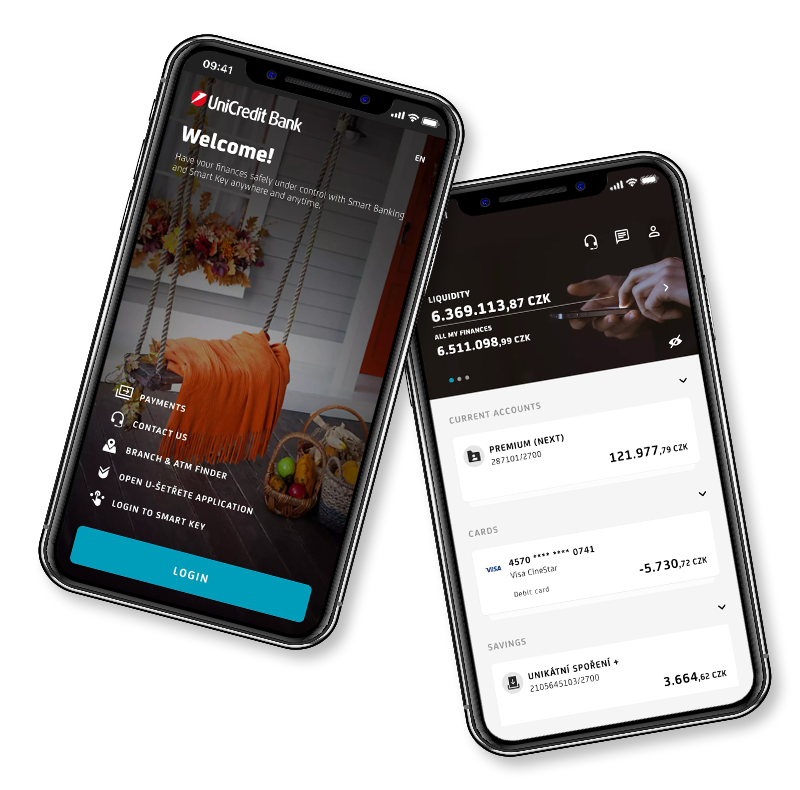

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

Dear Clients,

Act no. 256/2004 Coll., the Capital Market Undertakings Act, as amended (“the CMU Act”) has served to transpose Directive (EU) 2017/828 of the European Parliament and of the Council, amending Directive 2007/36/EC as regards the encouragement of long-term shareholder engagement (“the Directive” or “the SRD II”).

* * *

The objective pursued by the Directive has been to provide for long-term shareholder engagement in corporations whose shares have been admitted to trading on a European regulated market. Under the Directive, a company is entitled to know their shareholder and learn who the company shareholder is as at the applicable date.

A shareholder should be briefed on information of importance for it as a shareholder. Such information shall be passed by the issuer on to the depository who shall then pass the same on to the intermediaries who shall continue to pass such information further on until delivered to the shareholder. A shareholder has an option to send information to the issuer regarding the shareholder rights exercise as attached to the share, and, shall do so through the structure of the intermediaries who are required to pass such information upwards along the chain or may send it to the issuer or a person appointed by the issuer.

A limited time applies under the CMU Act for storing and processing data obtained and processed for the shareholder identification purpose and for the issuer-to-shareholder communication purpose, in order to facilitate the shareholder rights exercise and shareholder engagement in the company activities. Such data may be stored and processed up to one year from the date on which the issuer becomes aware that the person whose data has been stored and processed by the issuer has ceased to be a shareholder. The personal data use purpose follows from Art. 6, GDPR.

Depositories and intermediaries are entitled to require consideration for their services to get compensated for the costs incurred in information provision. Unless otherwise specified, the consideration of UniCredit Bank is already included in its fee for provision of respective investment services (depot fee/safekeeping fee in particular), and, is not designed as an add-on fee. Moreover, UniCredit Bank is entitled to be compensated for the third-party costs, including without limitation charges paid to the persons along the depository and intermediary chain.

* * *

The amended CMU Act has also introduced procedures aimed to improve the institutional investor and proxy advisor transparency. Institutional investors and asset managers will be in particular required to compile and publish an engagement policy, providing a description within it how they monitor the companies in which they invest assets.

Moreover, the Directive details enhanced shareholder engagement in remuneration to the Board of Directors, Supervisory Board and Management Board members, as well as to the other senior management members should the bulk of business management be delegated onto them (typically, Chief Executive Officer). Listed companies will be required to compile their remuneration policy to be approved by the Shareholders’ Meeting. In the transparency interest, the policy shall be published also on the issuer web pages. Listed companies will be required to prepare a remuneration report for each financial year, including remuneration provided to separate persons to whom the remuneration policy applies. The remuneration report shall be voted on in the Shareholders’ meeting and then published on the issuer web pages.

The Directive also regulates material related party transactions involving an increased threat of damaging in particular the company interests, or, interests of shareholders who are not a related party (minority shareholders). From now on, such material transactions, and, in particular those having a related party as a contractor, shall be submitted for approval to the Shareholders’ Meeting and also published on the issuer web pages.

Loading