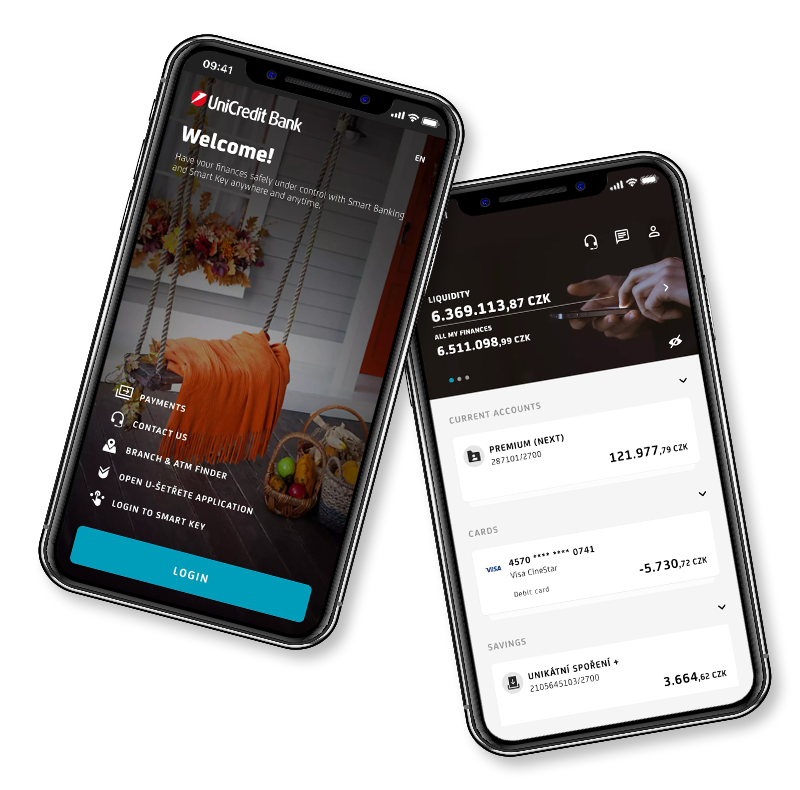

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

We would like to inform you about the transition of Amundi Funds Global Equity Target Income and Amundi Funds European Equity Target Income to responsible investing. An attractive dividend will remain with regard to the fund classes paying out dividends, but it will be of lesser importance in the overall performance.

Since 2020, both funds have been fully transitioning to responsible investing. What does it mean? In addition to the fundamental factors (profitability, development of sales, debt, dividend amount, competition, etc.), non-financial indicators will also be important when selecting shares, i.e. how a company engages in improving the environment, how it addresses societal and social issues, and how well and independently its top management works. We believe that these non-financial factors are increasingly intertwined with corporate performance and this trend will grow. Moreover, regulation and society’s pressure to change does not give companies much room for an alternative strategy. As a result, the shares of companies that will have a better socially responsible position should ultimately perform better. With respect to the shift of the strategy towards responsible investment, the name of both funds is changed to Amundi Funds European Equity Sustainable Income and Amundi Funds Global Equity Sustainable Income.

Another change announced for both funds is the change in dividend strategy. From the new year, the funds will no longer use the option strategy. This strategy fixed the targeted dividend at a higher level, ranging from 6 % to 7 % p. a., on the one hand, but partially limited further performance growth above the pre-declared dividend on the other hand. Removing the option strategy will reduce the declared dividend; therefore, the dividend payment should now be around 4 % p. a., however, the room for achieving over-performance for both funds compared to the market will significantly increase. We point out that 4 % p. a. is still more than the market can offer to investors. The current expected dividend yield on global equities is below 3 % p. a. Overall, investors will keep attractive dividends and the chances of better overall performance will increase.

We believe that most investors will welcome the change in strategy and will continue their investment, at least until the recommended investment time horizon (7 years or more). In such case, no cooperation is required from the investors. Investors who disagree with the change in strategy have the option of moving to another Amundi fund free of charge or terminating their investments, of course without any charge. Information on the funds concerned is available at www.amundi.cz.

Loading