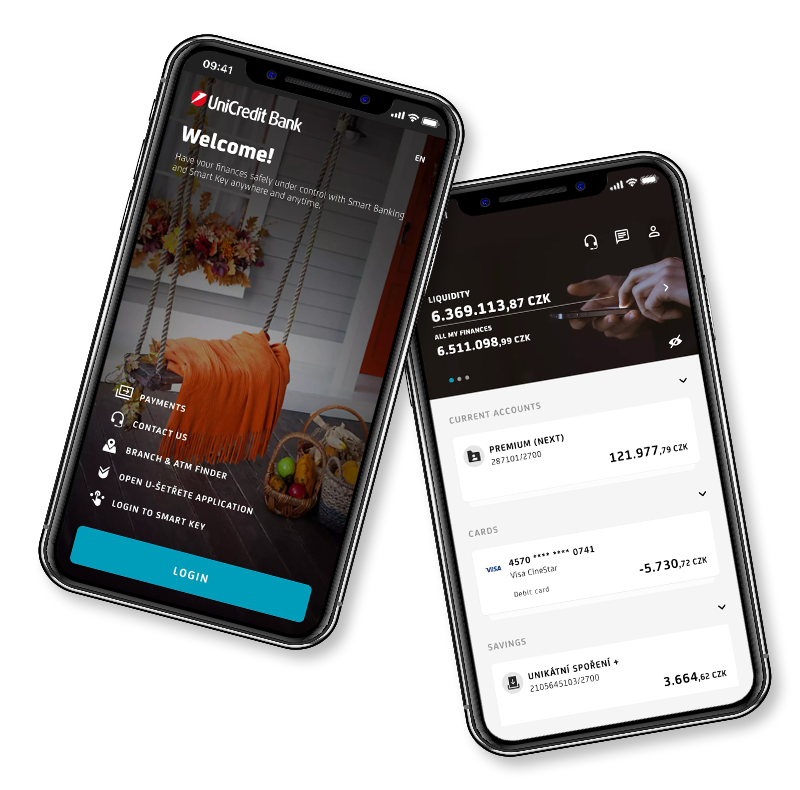

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

Environmental Social Governance

![]()

Impact on environment

Limitation of climate change

Low water consumption

Reduction of emissions

Optimal use of resources

Avoiding animal testing

![]()

Respect for social values

Respect for human rights

Equality

Social inclusion

Promoting accountability

Support for diversity

![]()

Beneficial corporate management

Anti-bribery and anti-corruption

More women in higher positions

Sound governance structures

Transparency

Fair competition

Dear clients,

please, become familiar with the information published by UniCredit Bank pursunat to Regulation (EU) of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (hereinafter “Regulation”).

The Regulation is intended to raise awareness among end clients and is aimed at sustainable, socially responsible investment and investment promoting good governance.

Transparency towards investors is a key element of the Regulation. It is about unifying the conditions for informing final investors in individual Member States. In particular, the European Union wants to provide companies with a framework within which they will be able to offer a wide range of products while respecting sustainable financing rules.

On 25 September 2015, the UN General Assembly adopted a new global sustainable development framework: the 2030 Agenda, which has at its core the Sustainable Development Goals (SDGs).

The transition to a low‐carbon, more sustainable, resource‐efficient and circular economy in line with the SDGs is key to ensuring long‐term competitiveness of the economy of the Union.

The Paris Agreement adopted under the United Nations Framework Convention on Climate Change, which entered into force on 4 November 2016, seeks to strengthen the response to climate change by, inter alia, making finance flows consistent with a pathway towards low greenhouse gas emissions and climate‐resilient development.

The EU is committed to achieving climate neutrality by 2050. Achieving this objective will involve transforming european society and the economy, which must be cost-effective and fair, as well as socially balanced. In this context, the Commission presented an anouncement on the EU Green Deal in 2019, which is to be the EU's new growth strategy to transform the Union into a climate-neutral, fair and prosperous society with a modern, resource-efficient and competitive economy. This objective is to be achieved in particular by adopting a regulatory base in a number of closely interconnected areas of the economy. Among other things, it is necessary to redirect financial flows into sustainable investments.

In accordance with the Regulation, UniCredit Bank hereby publishes information on the incorporation of ESG procedures into its investment and insurance advice.

Policy on the integration of sustainability risks – valid from 5th November 2021

Statement of principal adverse impacts of investment and insurance advice on sustainability factors – valid from 30th June 2023

Taxonomy is the shortened and established designation for Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088.

The European Union in fulfilling its goal of becoming a climate-neutral, fair and prosperous society with a modern, resource-efficient and competitive economy needs to redirect financial flows into sustainable investments.

The financial sector should reorient itself towards green investments and thus support the transition of the European economy to zero emissions. Companies' approach to financing will determine the extent to which their activities are in line with the Taxonomy of sustainable Investments.

The Taxonomy defines what criteria an economic activity must meet in order to be considered environmentally sustainable.

For the purposes of establishing the degree to which an investment is environmentally sustainable, an economic activity shall qualify as environmentally sustainable where that economic activity:

![]() contributes substantially to one or more of the environmental objectives set out in Taxonomy

contributes substantially to one or more of the environmental objectives set out in Taxonomy

![]() does not significantly harm any of the environmental objectives set out in Taxonomy

does not significantly harm any of the environmental objectives set out in Taxonomy

![]() is carried out in compliance with the minimum safeguards laid down in Taxonomy

is carried out in compliance with the minimum safeguards laid down in Taxonomy

![]() complies with technical screening criteria that have been established by European Commission

complies with technical screening criteria that have been established by European Commission

The Taxonomy sets out the following environmental objectives:

![]() climate change mitigation

climate change mitigation

![]() climate change adaptation

climate change adaptation

![]() the sustainable use and protection of water and marine resources

the sustainable use and protection of water and marine resources

![]() the transition to a circular economy

the transition to a circular economy

![]() pollution prevention and control

pollution prevention and control

![]() the protection and restoration of biodiversity and ecosystems

the protection and restoration of biodiversity and ecosystems

The aim of the Taxonomy is to provide firms and investment companies with an overview of what activities and in which sectors the European Union considers "green".

In recent years, the financial world has undergone a significant transformation and a shift in the ranking of values. In addition to performance, investors today also attach importance to the environmental, social and ethical impact of the investment itself. In order to enable investors to make sufficiently informed decisions, easier identification and comparison of sustainable products, the European Union

![]() adopted an action plan for sustainable finance to redirect capital flows to sustainable investments

adopted an action plan for sustainable finance to redirect capital flows to sustainable investments

![]() implemented various directives, regulations and tools towards better transparency and information in the field of sustainability

implemented various directives, regulations and tools towards better transparency and information in the field of sustainability

![]() has signed up to sustainable goals and a commitment to increase its responsibility in the field of ESG

has signed up to sustainable goals and a commitment to increase its responsibility in the field of ESG

Due to the strengthening ESG trend, the European Union amended the regulations in the field of providing investment services (MiFID regulatory framework):

The intention is to expand the information obtained from the client with his/her preferences in the field of sustainability.

When providing investment advice, the Bank will also take sustainability preferences into account when evaluating suitability, if the client has such preferences.

Likewise in product governance, i.e. when determining the target market, the Bank will take into account the client's sustainability preferences.

If the client does not declare any preferences in the area of sustainability, the Bank will be able to offer or recommend financial instruments to the client even without taking into account the characteristics of sustainability.

![]() Sustainable investment

Sustainable investment

Investment in an economic activity that contributes to an environmental objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance

![]() Sustainability factors

Sustainability factors

Environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters.

![]() Sustainability risk

Sustainability risk

Environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment

![]() Sustainability preferences

Sustainability preferences

Client’s or potential client’s choice as to whether and, if so, to what extent, one or more of the following financial instruments shall be integrated into his or her investment:

Similar to investments, the EU has also updated regulations in the area of distribution of investment-based insurance products

The intention is to expand the information obtained from the client with his/her preferences in the field of sustainability.

When providing insurance advice, the Bank will also take sustainability preferences into account when evaluating suitability, if the client has such preferences.

Likewise in product governance, i.e. when determining the target market, the Bank will take into account the client's sustainability preferences.

If the client does not declare any preferences in the area of sustainability, the Bank will be able to offer or recommend financial instruments to the client even without taking into account the characteristics of sustainability.

![]() Sustainable investment

Sustainable investment

Investment in an economic activity that contributes to an environmental objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance

![]() Sustainability factors

Sustainability factors

Environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters.

![]() Sustainability risk

Sustainability risk

Environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment

![]() Sustainability preferences

Sustainability preferences

Customer’s or potential customer’s choice as to whether and, if so, to what extent, one or more of the following financial products should be integrated into his or her investment:

Loading