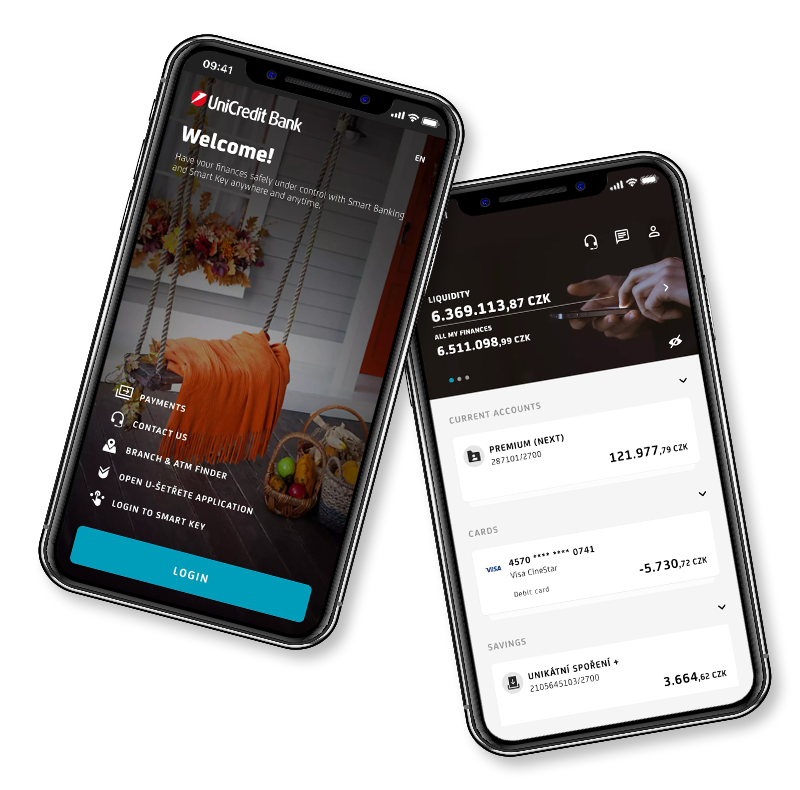

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

We have prepared tutorials and a list of frequently asked questions and answers to your questions about online and mobile banking.

You can easily set your card limits directly in the app by clicking on the card. You can find step-by-step instructions on how to do this in the attached guide.

You can temporarily block/unblock your card by clicking on your card directly in the Smart Banking app. Instructions are attached.

If you have blocked the Smart Banking app or if you have a new device, or are downloading the app again, you can simply activate it on your new device using your Username and the PIN you chose during the previous activation. In case you have forgotten your details, you can access the app by scanning your ID or we will be happy to help you on our Infoline +420 221 210 031. Instructions are attached.

We have observed cases when SMS for activation of Smart Banking application was not received abroad (most often within the USA, Canada). SMS delivery abroad is controlled by your phone operator and therefore we cannot prevent this situation. If you are abroad and have not received an SMS, please contact our Infoline +420 221 210 031 where we can help you resolve the situation.

You can easily collect the PIN for your card in your app by clicking on the card. Instructions are attached.

In order to use push notifications for logging in and confirming payments, you must have your phone connected to the internet and have notifications enabled, both in the Smart Banking / Smart Key app and in Settings on your mobile phone.

The password for communication with the bank is a password chosen by you, which is used for your authentication, for example, when you call our Hotline. If you do not remember your password, you can change it in your Smart Banking. Here are instructions on how to do this.

Smart key is available on the initial login screen above the “LOGIN” button.

Yes. In addition, Smart Banking will be there to help you if you need to quickly block your card due to loss, increase your limit for in-store purchases and also activate the U-šetřete discount program, which allows you to get benefits when paying with your card.

If you do not have an internet connection, you can use the alternative option of logging in using a QR code (offline), which does not require an internet connection. This option can be found by logging into Smart Key in the Smart Banking app.

Yes, Smart Banking puts all your current accounts, foreign currency accounts, savings accounts, term deposits, cards, loans and other products at your fingertips.

Yes, Smart Banking is also available abroad if your mobile phone is connected to the internet via Wi-fi or data roaming. We don't charge any fees for using the app. You can check roaming charges with your operator.

If you've used the app in the past, you can simply activate it on your new device using your Username and the PIN you chose during the previous activation. In case you have forgotten your details, you can access the app by scanning your ID or we will be happy to help you on our Infoline +420 221 210 031.

Smart Banking is independent of your mobile operator, so it will work with your new phone number (new SIM card). However, you will need to change your phone number to activate the app in the future, as we send an activation SMS to this number. If you already have the app active, you can also change your phone number in the MORE - MY PROFILE tab.

Yes, Smart Banking uses state-of-the-art security in the form of a security key. This generates a unique time-limited security code at each point in time that protects both logging into the app and sending transactions to the bank. Smart Banking login and payment signatures are protected by PIN, fingerprint or Face ID.

Even in this unpleasant situation, your data and finances are safe - thanks to the security key in the app, no one can access your finances and account without your PIN. The app can then be activated free of charge on your new device. Security is always fully guaranteed.

For security reasons, the application automatically shuts itself down after 3 minutes and logs out the logged-in user.

You probably have a version of the app installed that we no longer support. Simply update Smart Banking to the latest version by clicking the Update button and updating Smart Banking to the most current version in the secure Google Play/AppStore environment.

At the same time, we recommend that you turn on automatic updates for the Smart Banking app in your phone's Settings. This way your phone will update the app regularly and you don't have to worry about anything. This is the safest way to keep the Smart Banking app up-to-date with all the security enhancements and latest features.

The Smart Banking application is supported on all iOS 13.0 and above and Android 7.0 and above mobile phones with Google Play. The Smart Banking application is not supported for Huawei mobile phones that do not have the Google Play store.

Loading