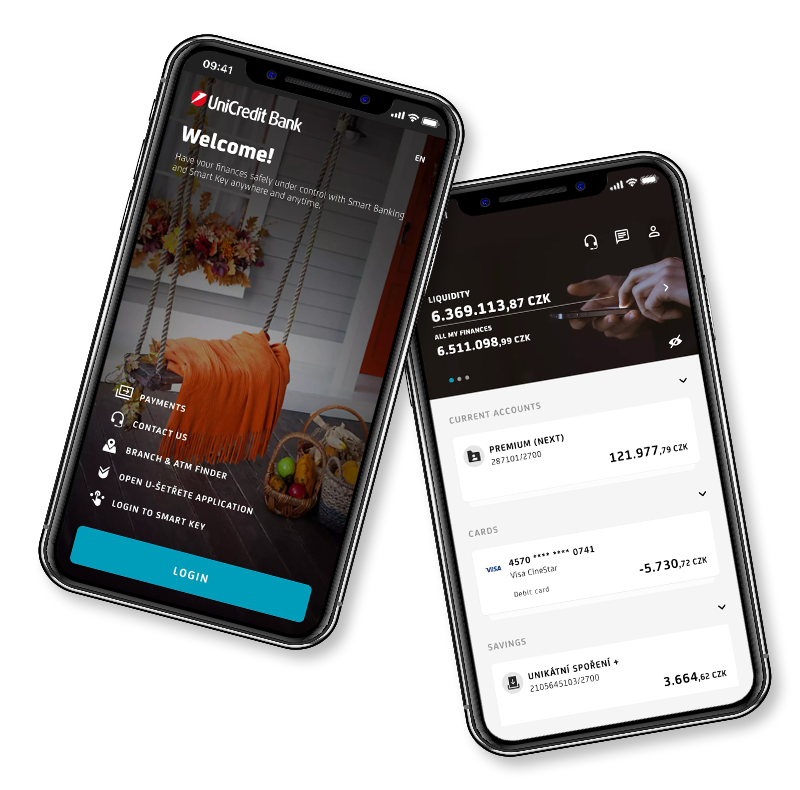

Smart Banking

UniCredit On Mobile

Keep your your accounts, cards and investments under control. Make payments and discover great deals.

In providing investment services, and especially in trading with investment instruments, UniCredit Bank adheres to rules established further to requirements stipulated by the Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments (“MiFID II“), resp.by the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing MiFID II as regards organisational requirement conditions for investment firms and defined terms that Directive (“Delegated Regulation”) and by Act No. 256/2004 Coll. on Capital Markets Undertakings, as amended (the „Act"). The primary aim of these rules is to protect clients, particularly with regard to the extent of information conveyed, the evaluation of information as to a client’s expert knowledge and experiences, and the evaluation of information on the rules of submitting and executing client orders concerning investment instruments.

For the archive of this information please click HERE.

Loading